If the 2023 stock market had an MVP, it would have to be Nvidia (NASDAQ: NVDA).

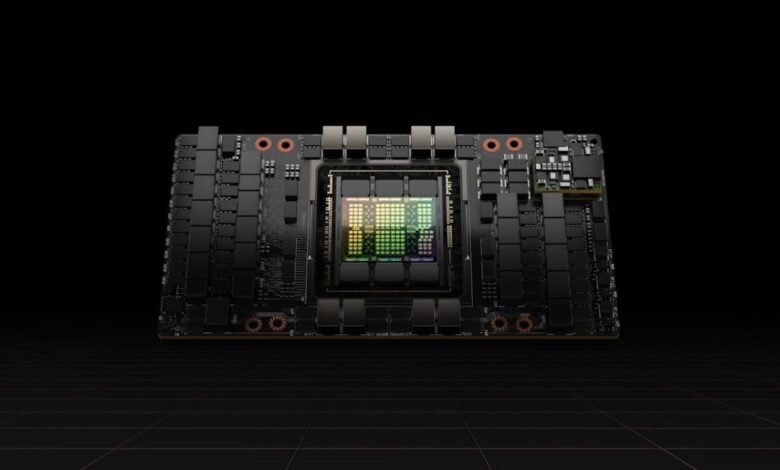

The chip maker and inventor of the graphics processing unit (GPU) has been the biggest winner in the generative artificial intelligence (AI) gold rush to date by far. Its revenue and profits have soared this year, and the stock has more than tripled year to date through Dec. 20. Along the way, the stock crossed the $1 trillion market cap, adding roughly $700 billion in market value and making it just one of five U.S. companies in that club.

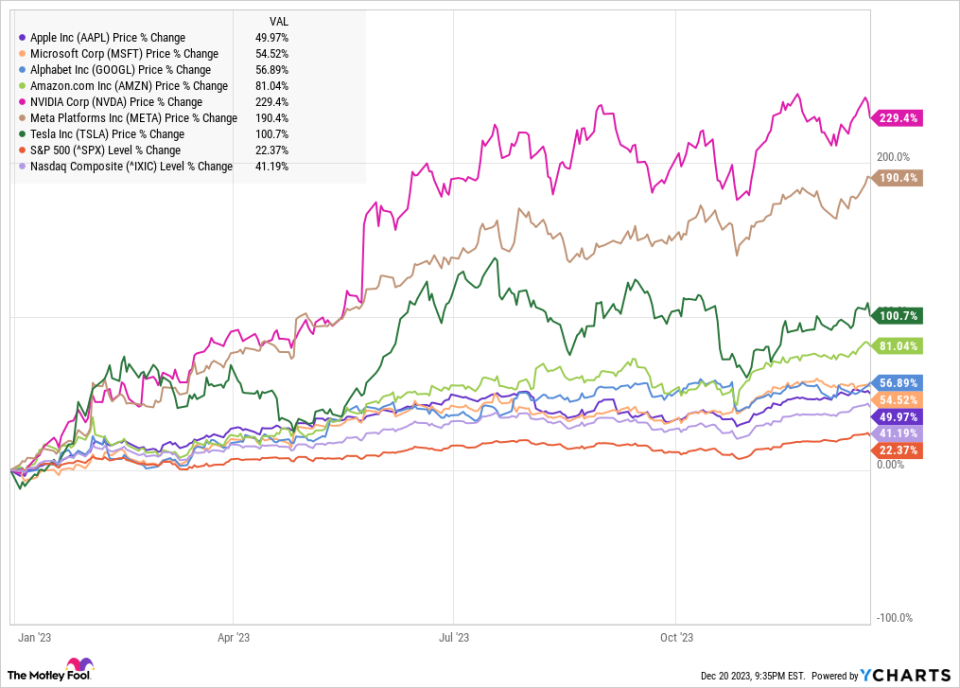

The other four companies are Apple, Microsoft, Amazon, and Alphabet. Together with Meta Platforms and Tesla, they’ve come to be known as the “Magnificent Seven,” which has replaced FAANG stocks as shorthand for big tech stocks. Together they represent roughly $12 trillion in market cap, and the group has delivered monster returns this year, with each one outperforming the S&P 500 and the Nasdaq, as you can see from the chart below.

Why Nvidia was the most magnificent stock of 2023

Nvidia started 2023 still reeling from the cryptocurrency crash in 2022, as demand for the company’s chips had spiked during the crypto mining boom in 2021.

Early in 2023, however, Nvidia emerged as a potential winner from the new generative AI technology revealed by the launch of OpenAI’s ChatGPT, and Nvidia has not disappointed.

As 2023 draws to a close, the chip maker has capitalized on the generative AI boom in a way that no other company has, and it has the numbers to show it. In its third quarter, revenue tripled from a year ago to $18.12 billion, and its margins expanded significantly, with generally accepted accounting principles (GAAP) earnings per share jumping more than 12 times to $3.71. On a GAAP basis, its profit margin was 51% in the quarter, and the company expects an even bigger fourth quarter, targeting revenue of $20 billion and a modestly higher gross margin.

Why 2024 could be another winning year for Nvidia

Nvidia is entering 2024 with a target on its back. It’s proven the market for AI accelerators and GPUs, and now semiconductor rivals like Advanced Micro Devices and Intel are launching their own AI accelerators. Big tech companies like Amazon and Apple are also entering the fray, designing their own chips for things like machine learning and neural engines, and for training large language models.

However, despite increasing competition, there’s a reason to bet on Nvidia’s continued growth in 2024. There’s still a significant shortage of AI chips as cloud infrastructure services, data centers, start-ups, and foundation models race to get ahold of the key infrastructure components to run new generative AI technology, which requires enormous computing power.

Companies including OpenAI, Oracle, Microsoft, and Alphabet have all complained about a shortage of AI chips, but that’s expected to ease next year — meaning Nvidia will face more competition for its H100 processors, which can cost more than $40,000.

However, Nvidia itself is betting on demand continuing to ramp up, with plans to triple production from 500,000 GPUs to at least 1.5 million next year. Increased competition could lower prices, but it’s unclear if anyone can compete with Nvidia in performance.

Nvidia has maintained a lead in GPUs since it invented them in 1999, and it could do the same in the AI space. The company also benefits from entrenched relationships with cloud infrastructure services like Microsoft, Oracle, Alphabet, and Amazon, as well as key customers like Tesla and OpenAI, and it’s built a powerful network of chips, software, and complementary products that will be difficult for rivals to match.

Prices for AI hardware could come down, but Nvidia seems likely to keep its reputation as the leader in AI performance. Repeating its performance as the best stock among the Magnificent Seven won’t be easy in 2024, but Nvidia looks well positioned to keep gaining next year as the generative AI boom only seems to be heating up.

Should you invest $1,000 in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of December 18, 2023

Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Jeremy Bowman has positions in Amazon and Meta Platforms. The Motley Fool has positions in and recommends Advanced Micro Devices, Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, Oracle, and Tesla. The Motley Fool recommends Intel and recommends the following options: long January 2023 $57.50 calls on Intel, long January 2025 $45 calls on Intel, and short February 2024 $47 calls on Intel. The Motley Fool has a disclosure policy.

This Is the Best-Performing “Magnificent Seven” Stock of 2023. Will That Change in 2024? was originally published by The Motley Fool

Source link